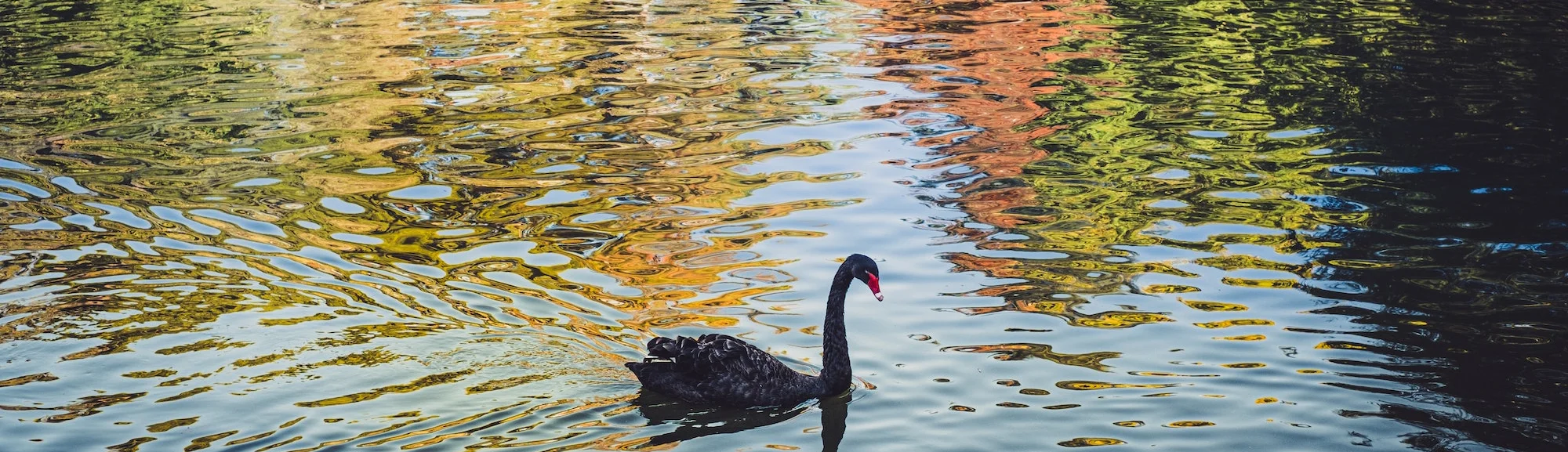

Black Swan

Black Swan events are rare and unpredictable events that have a significant impact on society, economics, and politics. In statistics, a black swan event is an occurrence that falls outside of the normal distribution of events, making it extremely difficult to predict or analyze.

The concept of a black swan event was first introduced by Nassim Nicholas Taleb in his book, "The Black Swan: The Impact of the Highly Improbable." Taleb argues that black swan events are often ignored by traditional statistical models, which rely on past data and trends to make predictions about future events. However, these models are not equipped to handle rare and unpredictable events, leading to significant underestimations of risk and uncertainty.

Black swan events can be both positive or negative, depending on the context and perspective. For example, winning a lottery could be considered a black swan event for an individual, and it would be viewed as a positive event. Similarly, the invention of the internet could be considered a black swan event that had a significant positive impact on the world. On the other hand, natural disasters, terrorist attacks, or pandemics could be considered negative black swan events due to the damage and suffering they cause.

In the world of finance, black swan events can have disastrous consequences. The global financial crisis of 2008, for example, was a black swan event that caught many investors and financial institutions off guard. The collapse of Lehman Brothers, a major investment bank, triggered a chain reaction of failures that led to a global recession.

In other fields, black swan events can have similarly catastrophic effects. The COVID-19 pandemic, for example, was a black swan event that disrupted economies and societies across the globe. The emergence of a highly contagious and deadly virus was unexpected and difficult to predict, leading to a significant loss of life and economic damage.

To account for black swan events, statisticians and risk managers have developed new methods and models that take into account extreme events and their potential impact. One such approach is called "extreme value theory", which focuses on analyzing the distribution of extreme events rather than the average or typical events. Other approaches include scenario analysis, stress testing, and Bayesian modeling.

In conclusion, black swan events are rare and unpredictable events that have a significant impact on society and economics. Traditional statistical models are not equipped to handle these events, leading to significant underestimations of risk and uncertainty. To account for black swan events, new methods and models have been developed that focus on extreme events and their potential impact. As the world becomes increasingly complex and interconnected, the need to understand and prepare for black swan events will only become more important.